10 Easy Facts About Home Equity Loan Vancouver Explained

Table of ContentsThe Second Mortgage Vancouver StatementsFascination About Foreclosure LoansThe Facts About Home Equity Loan Vancouver RevealedThe Only Guide to Foreclosure Loans

The amount a home owner is enabled to obtain will be partially based on a consolidated loan-to-value (CLTV) proportion of 80% to 90% of the residence's appraised value (Foreclosure Loans). Of training course, the quantity of the car loan as well as the interest rate charged likewise rely on the borrower's credit report and also settlement background. The customer makes routine, fixed settlements covering both major and interest. As with any mortgage, if the financing is not repaid, the residence can be marketed to please the continuing to be debt. A home equity financing can be an excellent way to convert the equity you've developed in your home right into money, particularly if you invest that money in home remodellings that enhance the worth of your house.

Need to you wish to relocate, you may finish up losing cash on the sale of the residence or be incapable to move. And if you're obtaining the car loan to pay off bank card financial debt, stand up to the temptation to run up those charge card expenses once more. Prior to doing something that puts your home in jeopardy, consider all of your options.

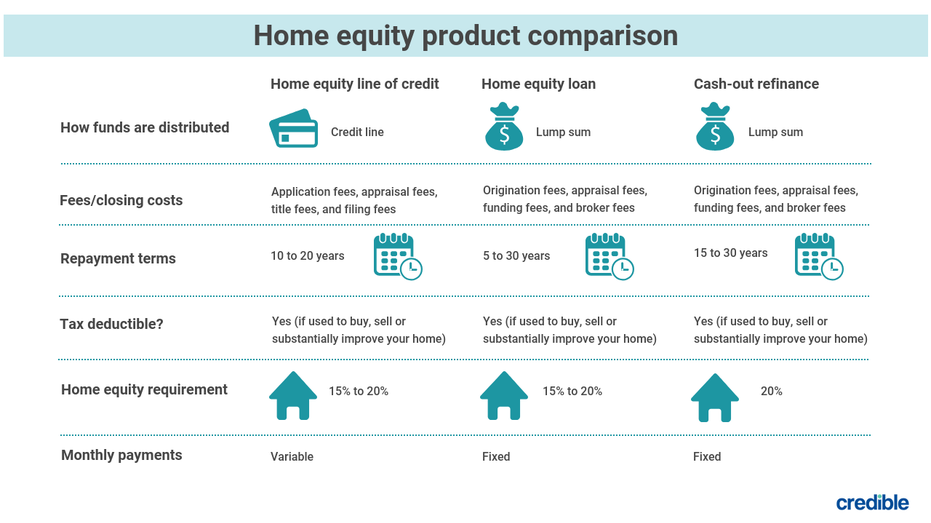

The Tax Cuts as well as Jobs Act of 2017 suspended the reduction for rate of interest paid on home equity finances and HELOCs till 2026, unless, according to the IRS, "they are made use of to purchase, develop, or significantly improve the taxpayer's house that secures the financing." The passion on a home equity loan made use of to consolidate financial debts or pay for a child's college expenditures, for instance, is not tax insurance deductible.

When looking, consider a funding with your neighborhood cooperative credit union as opposed to concentrating only on big financial institutions, recommends Clair Jones, a realty and also relocation professional that composes for and also i, MOVE.com. "Debt unions occasionally offer better rate of interest and even more customized account service if you're eager to take care of a slower application processing time," Jones states.

The Best Strategy To Use For Home Equity Loan Vancouver

, which is a significant cost.

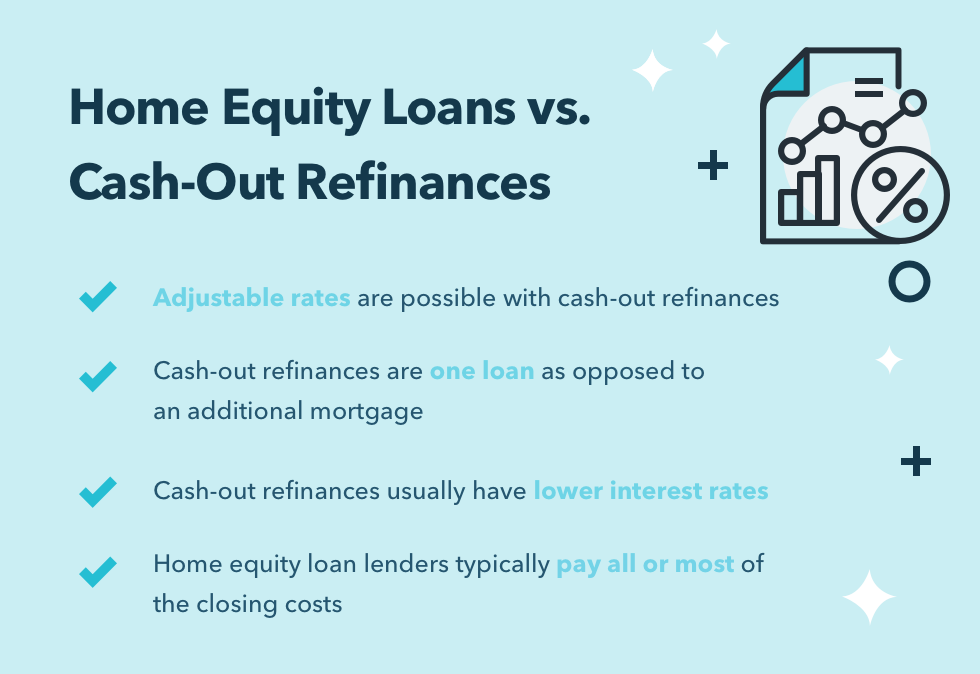

House Equity Loans vs. HELOCs Home equity finances offer a solitary lump-sum repayment to the consumer, which is paid back over a collection period of time (generally 5 to 15 years) at an agreed-upon interest price. The payment as from this source well as interest price continue to be the very same over the life time of the funding. The lending needs to be settled completely if the house on which it is based is sold.

(5 to 10 years) is followed by a payment duration when attracts are no much longer permitted (10 to 20 years)., including expense, yet there are likewise drawbacks.

All about Home Equity Loans Vancouver

If you have a steady, reliable resource of revenue as well as recognize that you will be able to pay back the lending, low-interest prices and possible tax obligation deductions make residence equity loans a practical choice. Acquiring a residence equity loan is fairly easy for several consumers due to the fact that it is a protected financial debt.

The rate of interest on a house equity loanalthough greater than that of a first mortgageis a lot reduced than that of bank card go to the website and also other consumer car loans. That aids clarify why a primary reason customers obtain against the worth of their homes using a fixed-rate home equity finance is to repay credit card balances.

Also, know that the interest paid on the portion of the funding that is above the value of the residence is never ever tax obligation insurance deductible. When getting a residence equity finance, there can be some temptation to borrow greater than you promptly need due to the fact that you only get the payment when, and you do not recognize if you'll get approved for one more lending in the future.

Not known Facts About Home Equity Loans Vancouver

Were you not able to live within your means when you owed only 100% of the equity in your house? If so, it will likely be impractical to expect that you'll be much better off when you raise your financial obligation by 25%, plus passion and costs. This can come to be a domino effect to insolvency as well as repossession.

Combining that financial obligation to a house equity car loan at a rate of 4% with a term of five years would actually cost you even more money if you took all 5 years to settle the house equity loan. Keep in mind that your house is now collateral for Foreclosure Loans the lending instead of your car.

, so adjust your price quote as needed considering the current condition of your residence. Split the current balance of all fundings on your residential property by your current residential property value quote to obtain your present equity percent in your house.